reddit interest rates|interest rates today reddit : Bacolod October was the height of the interest rates. Check out bankrate.com to see . Resultado da Sonhar custa caro mas desistir custa um sonho. A verdadeira felicidade consiste em viver a justiça. Só assim a pessoa tem consciência tranquila, e não se sente .

0 · what are normal car interest rates reddit

1 · upstart interest rates reddit

2 · reddit mortgage rates today

3 · interest rates today reddit

4 · current interest rates reddit

5 · current auto loan rates reddit

6 · cheapest auto loan rates reddit

7 · average mortgage rates today reddit

8 · More

Resultado da Click the Browse button to select the video you want to compress for WhatsApp. Step 2. Set the specs - you can choose the quality level, video resolution, and whether .

reddit interest rates*******The Fed wants it at 2%. The unofficial reasons are more complicated, but the most common are: The stock market, and housing market are priced too high, and cutting interest .

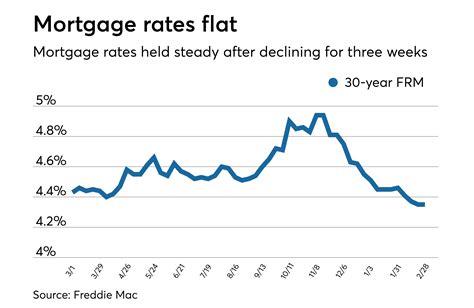

October was the height of the interest rates. Check out bankrate.com to see .

Fed predicts fed rate going up to 4.6% by early next year, 4.4 by the end of this .

Parents want to refinance for a higher interest rate. My parents want to do a .October was the height of the interest rates. Check out bankrate.com to see competitive refi rates in your area. Also there may be a time limit on when you’re able to refi (in TX .Fed predicts fed rate going up to 4.6% by early next year, 4.4 by the end of this year (which is a 75bp, 50bp, and 25bp increase, in that order - give or take). Banks may swallow .There is Math and there is Personal Interests The top 0.1% have money, the 99.9% have dept. If there are a lot of money printed, the value of the money goes down, the only way to collect it back is higher interest rates on the 99.9% and .Mortgage rates are already trending north of 5% and the fed funds rates have barely moved. There is a lot of excess demand, but at the end of the day buyers have to afford monthly payments and each additional 1% in interest rates is comparable to about an increase of 10% in the purchase price.

Doubt they move down in lock step. If fed funds rate drops to 3%, mortgage companies and builders would slowly drop their rates until the find the sweet spot. People will be chomping at the bits to get 5.5% 30-year mortgage. They don’t move in lockstep, but the Fed’s rate heavily influences mortgage rates.

Use federal loans only, always, assuming you qualify. They come with so many benefits and so many ways to simply not pay them back, including (possibly/likely) many years of 0% effective interest, plus you get payments based on income— no .

Everyone was assuming that the Fed might hike rates one more time this year and that we peak on the interest rate cycle. HYSA rates are around 5%, CD rates are approaching 6%, the national 30 year mortgage average in the US is almost 7.5% (a 20 year high). However a very strong jobs report combined with the new war in the Middle East seem to .

Most of the time the data is atleast 90 days old. There is nothing premeptive abou the Bank of Canada's monitary policy. Historically it has enacted policy as a reaction to the economy. If the economy crashes drop interest rates, if the economy explodes raise interest rates. The policy is aimed to try to balance out the highs and lows of the .Most of the current inflation is due to mortgage interest, thus in reality shelter may increase, however, mortgage interest will decrease. In reality it’s not as cut and dry as you think. Most of the excess inflation maybe. Mortgage interest currently accounts for 1.1% (1.1pp) of the current 3.4% (3.4pp) inflation.

reddit interest rates interest rates today redditNow when we look at historical home prices relative to interest rates, 5% is no longer a good rate, as housing prices are drastically higher than ever before. 5% is no longer a good rate. If rates will be 4% or below, house prices will go through roof. All people who missed out on low rate will rush into buying .

Lol that is me. Bought my house in 2018 at a decent 4.5% rate and refinanced at 3.0%. If I bought that same house today with today's inflated market prices and the 7% interest rate with it, I can't even fathom what the monthly mortgage payments would be compared to what I'm currently paying.Currently paying about 4.5% on terms between 90 days and 24 months so very similar. It goes to lenders. At bottom, lots of money originates from the central bank, which is the ultimate lender. When the central bank issues loans, it does so with new money created from thin air, which increase the total money supply.interest rates today redditCurrently paying about 4.5% on terms between 90 days and 24 months so very similar. It goes to lenders. At bottom, lots of money originates from the central bank, which is the ultimate lender. When the central bank issues loans, it does so with new money created from thin air, which increase the total money supply.reddit interest ratesKudos. I also have 800+ score (TU) and just got 7.77% for used 60mo (Capital One). Be it 6.8% or 7.77%, it still seems too high to me. I haven't paid a rate like this for a vehicle in 20 years.

ADMIN MOD. Raising interest rates to actually fight inflation. This more a hypothetical question for those smarter than myself. Let’s start with my understanding of how raising interest rates impact inflation: Right now, my money is sitting in my savings account doing nothing. Goods and services are getting more and more expensive everyday.

Took the mortgage on Oct 2018 - $600,000 (initial amount) Renewed with the same borrower on Oct 2023, did some lump sum payment and now currently have 300k owing. At the time of renewal, my monthly payment was calculated to be $2050 and I opted to pay $3000 per month.

It is still around there now. Meanwhile federal student loan interest rates had been 4 - 6.8% over that period and to this very day. That is totally unjust. All student loans should be permanently set to whatever the lowest rate the Fed gave to banks in a bailout: near-zero.Kudos. I also have 800+ score (TU) and just got 7.77% for used 60mo (Capital One). Be it 6.8% or 7.77%, it still seems too high to me. I haven't paid a rate like this for a vehicle in 20 years.ADMIN MOD. Raising interest rates to actually fight inflation. This more a hypothetical question for those smarter than myself. Let’s start with my understanding of how raising interest rates impact inflation: Right now, my money is sitting in my savings account doing nothing. Goods and services are getting more and more expensive everyday.Took the mortgage on Oct 2018 - $600,000 (initial amount) Renewed with the same borrower on Oct 2023, did some lump sum payment and now currently have 300k owing. At the time of renewal, my monthly payment was calculated to be $2050 and I opted to pay $3000 per month.It is still around there now. Meanwhile federal student loan interest rates had been 4 - 6.8% over that period and to this very day. That is totally unjust. All student loans should be permanently set to whatever the lowest rate the Fed gave to banks in a bailout: near-zero.I like many NFL fans signed up for the minimum one month subscription at $5.99/month. Looking back for when my "free trial" expired I realized that there was NO free trial period and I paid for a month. When I went to cancel, they offered me THREE months at $2.50/month just to stay.Get app Get the Reddit app Log In Log in to Reddit. Expand user menu Open settings menu. Log In / Sign Up; Advertise on Reddit; Shop Collectible Avatars; . Yes savings accounts interest rates at competitive banks should start to increase soon. The Fed increased their target for the Federal Funds Rate by 0.25% today so your account may .One couple got a $750 k loan fer their 1.2 m conservative house. me think their rate be 2% or something. So $15 k in interest alone per year nay including their principal component. If rates sail t' 6%, their interest alone will be $45k per year, where thar f be they meant t' pull a extra $30 k from per year t' jusy cover thar interest..If you have any debt with higher than a 6% rate you can write the lender with a copy of your orders, and get a refund of any excess interest you may have been charged. In a rising rate environment where the Fed rate is 4% and lenders need to charge in excess of that to make money.. pay close attention to what you’re paying and you may get a .If 20% down with 8% interest rate fits your budget (Account for 1-2% of property value for maintenance every year). Then buy if not wait and save more until it does fit. Reply reply. doctorkar. •. Nope, never. I bought in 2007 at 6% for a 15 year. Obviously rates have gone much lower since then.If rates then continued to go up, once I cut back on completely unnecessary expenses, interest rates would have to go up 4.5% from where they are now for me to have to make real sacrifices. If we went up 7% from where they are now, I'd have to get a housemate.Fed holds rates steady, indicates three cuts coming in 2024. The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond. With the inflation rate easing and the economy holding in, policymakers on the Federal Open Market Committee voted unanimously .3.3% at Evansville Teachers Federal Credit Union. $20,000 limit, requires 15 debit purchases (any amount) each month and an electronic deposit. 3% at One Finance. No limit, but funding the 3% account is limited to 10% payroll/benefits direct deposits, up to a maximum of $1,000 per month. Although not strictly a checking or savings account, it's .

Resultado da 23 de nov. de 2023 · Só Novinhas BR - O melhor site de gatas da internet. Confira aqui os melhores vídeos de ninfetas e vídeos amadores que caiu na net em sites como Redtube, Pornhub e Xhamster. Novinhas gostosas e novinhas lésbicas com os melhores nudes do porno amador. Aviso: Nós .

reddit interest rates|interest rates today reddit